AXA Fixed Assets

The “AXA Fixed Assets” professional manager tool was my first project at Foolproof, commissioned by AXA to help their clients monitor and protect their warehouse portfolios. The brief was open-ended — AXA wanted an interactive map that displayed all insured assets in one place.

Through discovery, it became clear that AXA needed more than a visual map: they required a tool to help large companies quickly assess risks from natural disasters and take action to reduce potential damage and insurance claims.

The “AXA Fixed Assets” professional manager tool was the first project I was involved in at Foolproof.

AXA's brief was very loose. They contacted us directly, as we've previously worked with them, asking us to design a map (a website) that would allow their customers to see, in one single space, the entirety of their warehouse portfolio. The map was intended to track any anomalies caused by wildfires, floods, earthquakes or any other natural calamity that could jeopardise these company's stock.

Soon enough I understood that what AXA was looking for was a tool that would enable all the big companies, insured with them, to promptly protect their portfolio and reduce damage claims.

The problem statement

AXA pays-out millions to insured companies because of natural disasters claims.

This became the starting point for several workshops and brainstorming sessions (led by me), to help my team and I develop a whole new strategy for the product that AXA was really looking for.

Amongst the various different HMW statements, that we formalised, was the following: How might we incentivies AXA customers to reduce their claims, by helping them take successful actions to protect their stock and portfolio?

From our research (face to face interviews) we understood that most, if not all, of the companies insured with AXA, had risk managers whose duties were to protect their warehouses and stock. Their job is basically to come up contingency plans to prevent damages from natural disasters, amid other perils such as unauthorised access, thefts and protests in the surrounding neighbourhoods.

This led us to modify the maps we had designed and to rethink the entire strategy of the product. We advised our AXA stakeholders of the opportunities they could leverage to reduce payouts and how to involve, positively, the collaboration of companies in managing their risks. In detail we explained:

- communicate in real time — and from one single place — between all the warehouses and shops in their portfolio. They were looking for a piece of kit that could help them react promptly to any emergency

- that by incentivising their customers to actively protect their stock and portfolio, AXA would reduce their losses (fewer payouts) and increase profits. To motivate insured companies, we adviced AXA to discount premiums once they adopted the “AXA Fixed Assets” tool

- that by creating the “AXA Fixed Assets”, rather than just a simple map, AXA risk manager experts could influence and suggest weekly actions and recommendations to empower businesses to plan better for risks.

AXA was enthusiastic about our ideas. They wanted us to promptly change direction to created the new “AXA Fixed Assets” website.

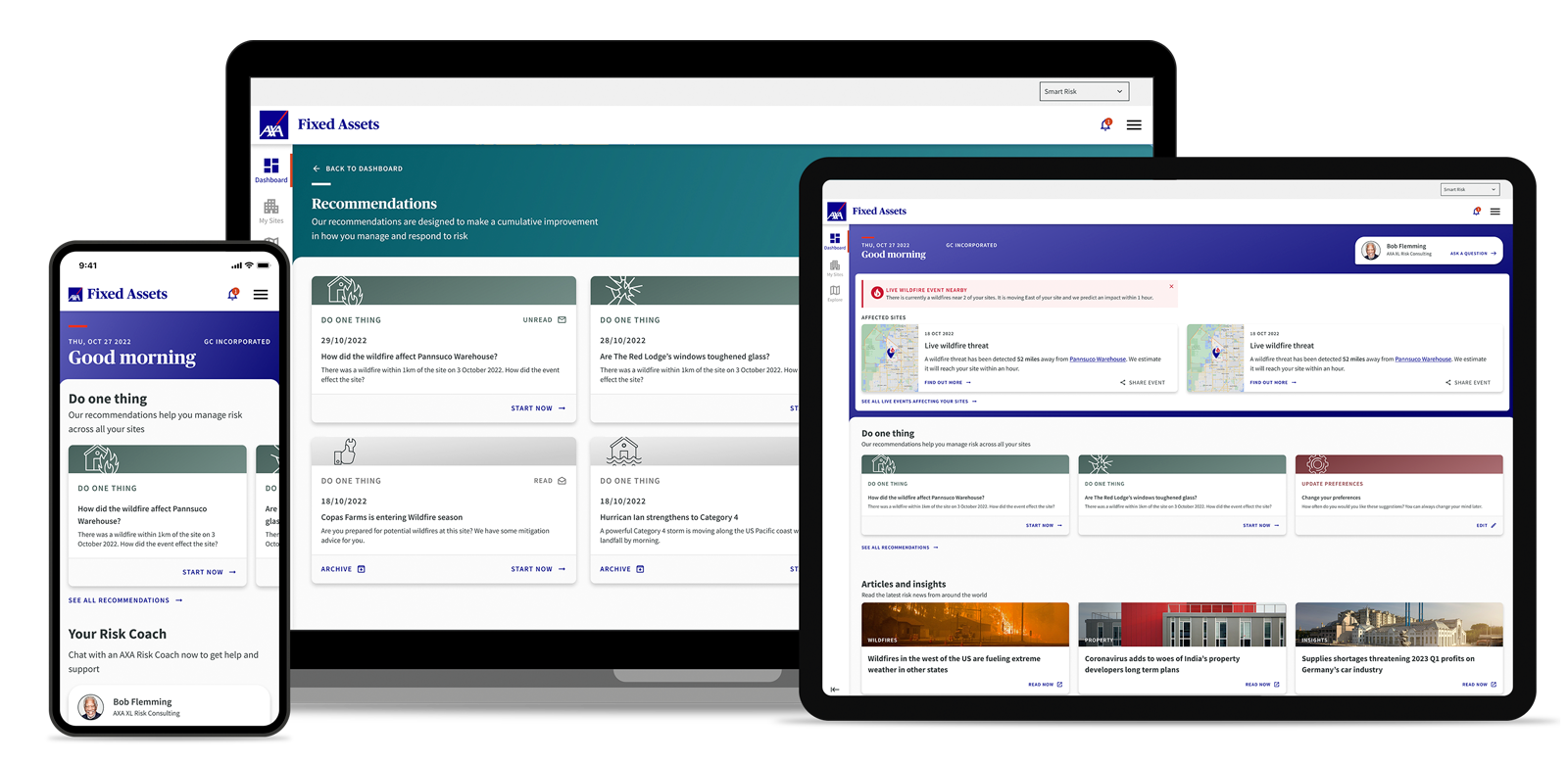

This tool was iterated upon the initial map, which we then enriched and integrated with plenty of new features. To use an analogy, it became a sort of “supercharged” Slack which included the:

- Dashboard

- Recommendations

- Risk Manager Coach

- Risk Manager Chat

- Alerts and notifications

- My Sites (the original map)

- Explore

The Dashboard

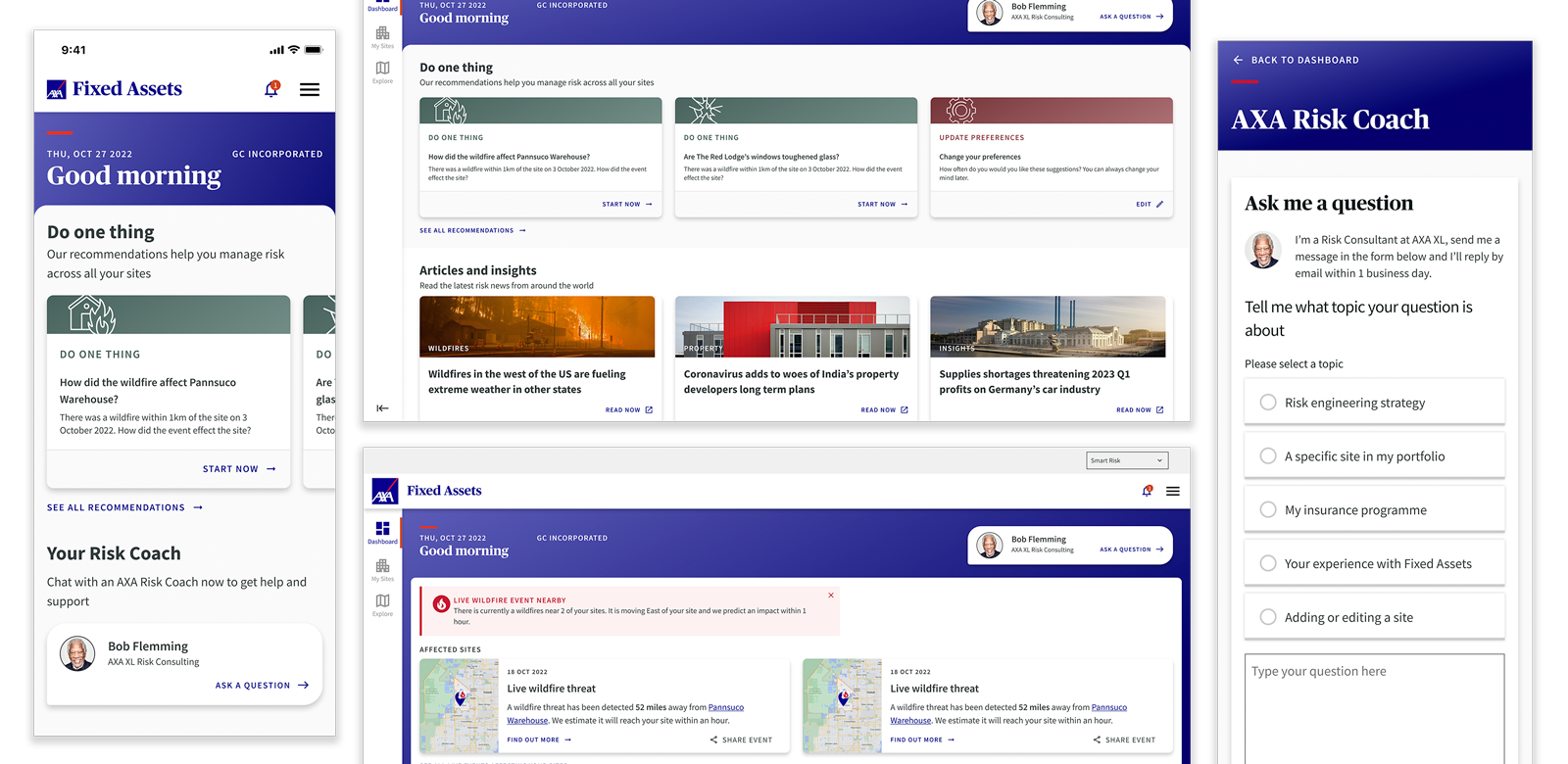

This is the website’s homepage where all the portfolio insights can be accessed at a glance, hosting the:

- Risk Manager Coach, a machine learning chatbot (based on LLM) to support users with instant information. In fact we introduced AXA to the potential of integrating the website with AI solutions to speed up suggestions and react naturally to user’s inputs. It would learn from these inputs generating, on a weekly basis, personalised recommendations

- Recommendations called “Do one thing” to entice risk managers to actively take steps to reduce risks and to earn rewards

- Playbooks designed to respond to a wide range of risk scenarios

- Then at the very top of the dashboard alerts and notifications would appear in case natural disasters or any other threatening events were to affect a particular site

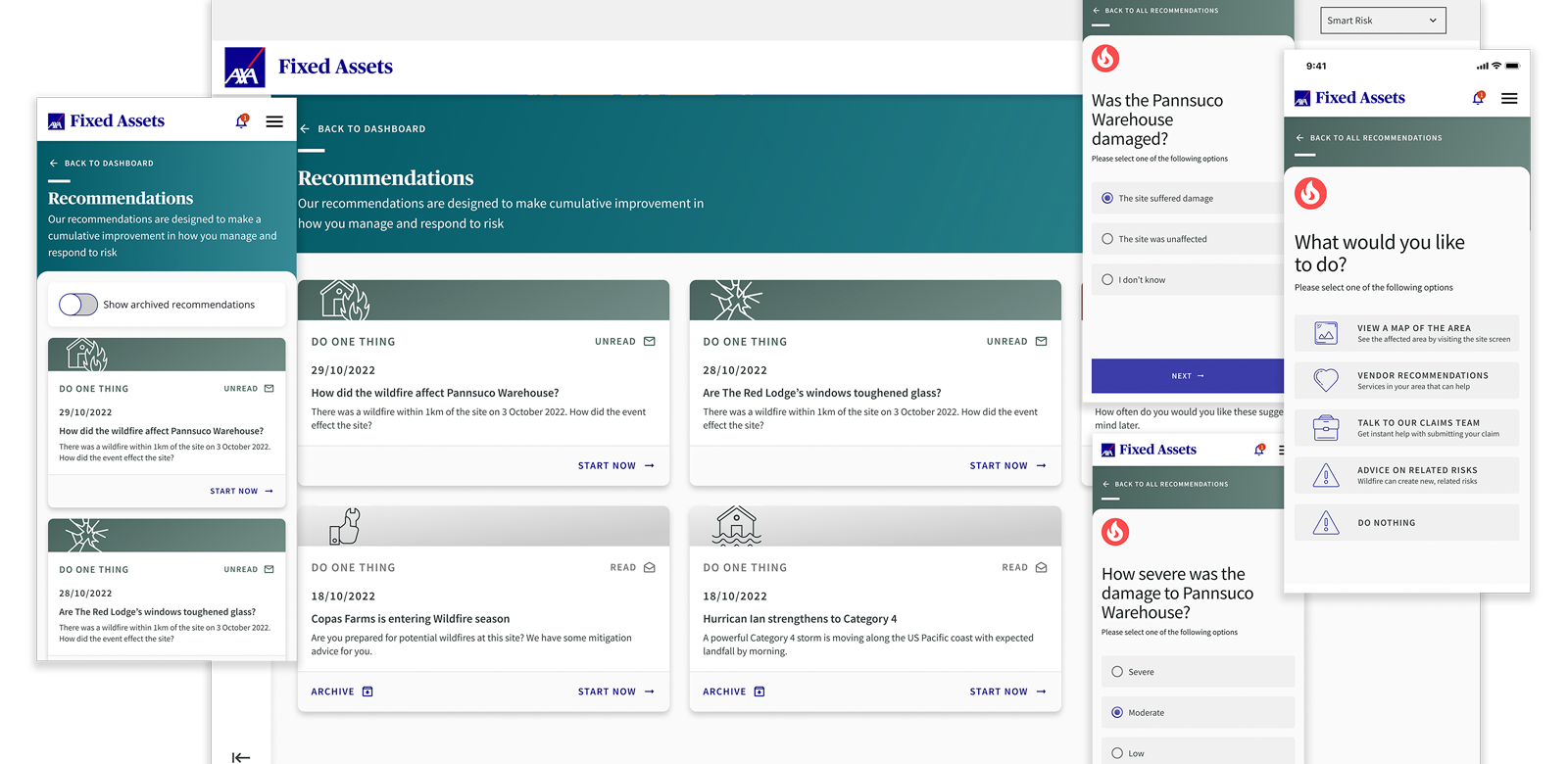

Recommendations

This part of the website — as hinted above — is designed to engage users with rewards, almost as a loyalty scheme, to earn discounts on the subscription of the "AXA Fixed Assets" tool or of their premiums, which in turn would help AXA reduce payouts.

Here are hosted all personalised suggestions and actions that AXA experts and the “Risk Manager Coach” would generate for one specific customer.

It would display daily, weekly and monthly suggestions designed to make cumulative improvements in how one manages and responds to risk. Users would click on one card, for example, and AXA would guide them to perform or adopt specific strategies or actions to secure their sites and mitigate risks.

In other cases AXA would ask for feedback or insights around a specific disaster, e.g. if a warehouse had sustained damages from a wildfire. AXA could then understand the level of impact it had on the structure and the stock, but also learn from the event — through the Risk Manager Coach — developing more suggestions and guides.

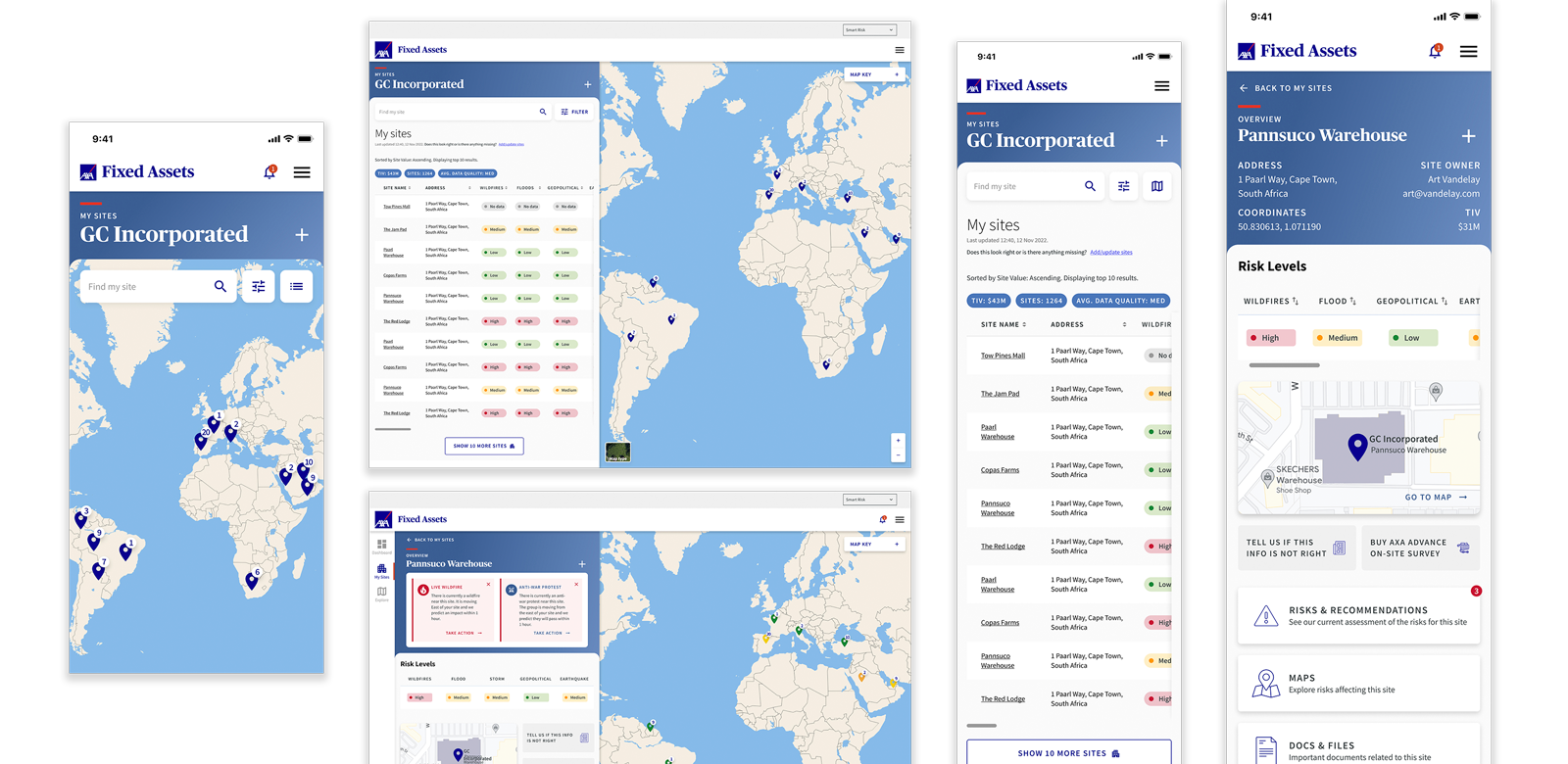

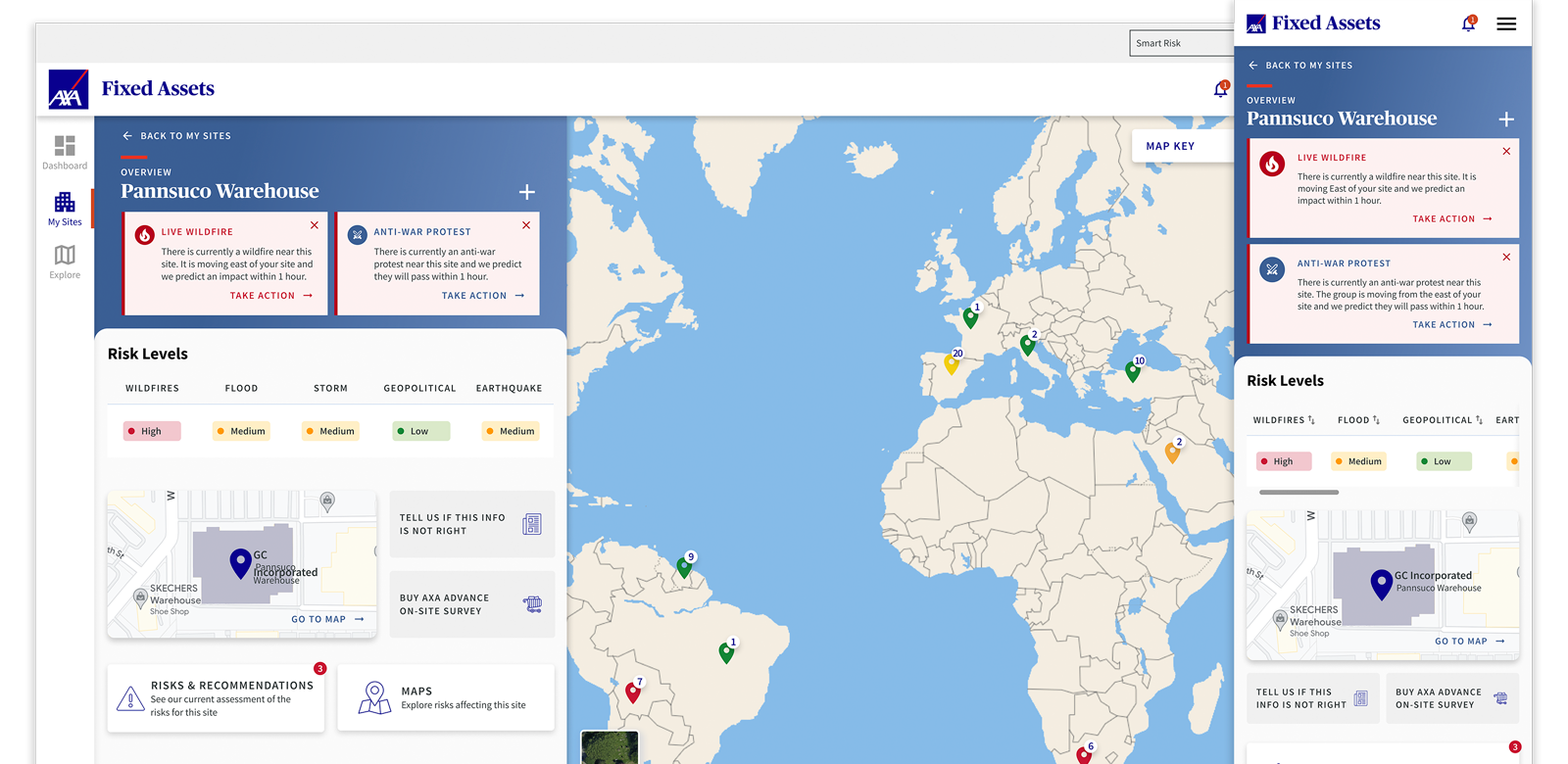

My Sites

In “My Sites” risk managers have an overview of all their sites on a map view, they can see all their portfolio worldwide in an interactive pin format that they can click. Each pin may or may not have numbered notification dots (unread chat or dangers) and is coloured coded with either AXA blue, green, orange and red:

- Blue, no risk and notifications only refer to unread chats

- Green, low risk. Some event might affect the assets but it is highly unlikely. Most of the time this type of notification dot relates to inaccuracy of information, corrupt databases (which AXA would prompt to rectify) or very remote dangers

- Orange, medium risk. This usually requires attention, preparation and monitoring the site and its surrounding areas, for at least the next 72 hours

- Red, high risk. In this unfortunate event the site needs to evacuate employees and where possible secure its stock, machinery and vehicles. In summary it’s like preparing for imminent impact

From the “My Sites” page of the website, risk managers are able to understand in real time which sites have issues and prepare for various eventualities.

They can chat directly to the managers of each site and coordinate their response together, whilst in everyday situations they can make sure that plans are being put in place and tested regularly. They can monitor if all their sites are operating as usual or if there are imminent issues to fix, by simply supporting remote colleagues to take action.

As I mentioned above the “My Sites” section of the site is like a supercharged Slack that helps risk managers monitor, chat and act upon any risk that may affect their portfolio.

Explore

Finally the Explore section of the website — in map view as well — is a window across the world, powered by AXA’s AI, with news, articles and playbooks where users can understand, in real time, what’s happening across the globe. Here they can see critical information about events and dangers affecting other AXA insured companies (only generic information) such as natural events, wars, protests and other risks in order to help prepare for the worst.

AXA are still ironing out the final details and have joined forces with Zensar (Foolproof’s parent company) to optimise and deliver the AI software powering the "AXA Fixed Assets" tool.

Results

2%

3.15%